Attend Conferences in Your Areas of Interest! #activeretirement #retireinspired #retireyourway

Remember when you were at the peak of your career, and you represented your organization at conferences? How proud did […]

Remember when you were at the peak of your career, and you represented your organization at conferences? How proud did […]

When we retired 2 years ago, our initial goals were to get some much needed rest, and restore our health. […]

Now that we are in our early 60s and retired, it’s time to decide if we want to grow old […]

How well do you know your spouse or significant other? If you met 30 years ago, do you really know […]

When baby boomers go on vacation, are they looking for wild parties or peace and quiet? My guess is they […]

What’s on your bucket list? One of my bucket list items is to see a professional play in the middle […]

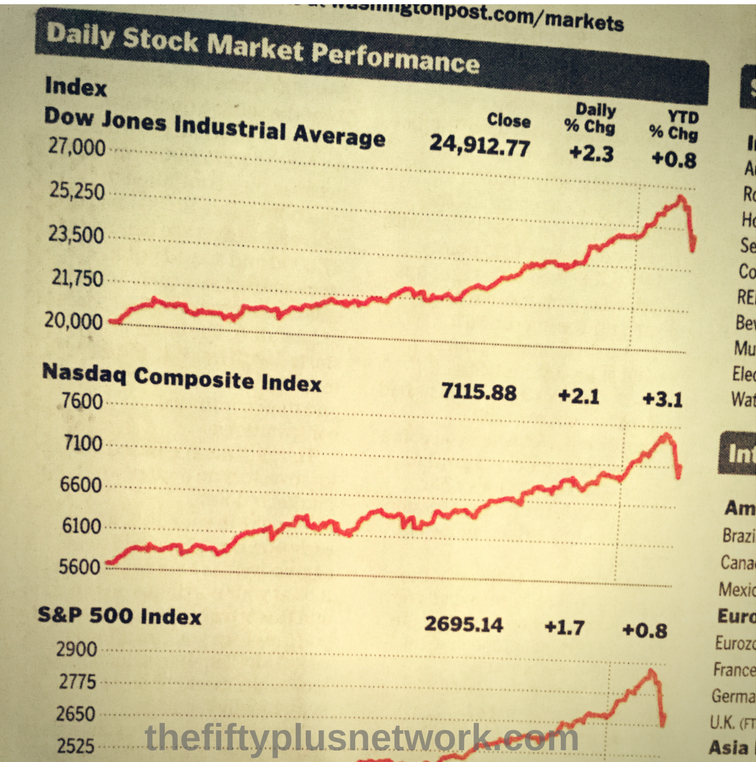

If you are retired, or within a few years of retiring, the recent volatility in the stock market must be […]

When I left my job for the last time, I drove away with a tear in my eye. I played […]

“Giving back” feels good. Helping those who are less fortunate is a noble thing to do. If you can have […]

Retirement gives you the freedom to schedule activities during non-peak times. For example, the lake is very popular on the […]