The 60s Are No Joke! #aging #womenover50 #womenover60

When I was in my 50s, I still felt young. I had the typical aches and pains that physical therapy […]

When I was in my 50s, I still felt young. I had the typical aches and pains that physical therapy […]

Remember when you were at the peak of your career, and you represented your organization at conferences? How proud did […]

When we retired 2 years ago, our initial goals were to get some much needed rest, and restore our health. […]

Don’t have the time or money for an exercise plan or gym membership? The quickest, easiest way to lose weight […]

“We don’t have long to live …” were my husband’s words to me after witnessing our pastor breakdown on this […]

What’s on your bucket list? One of my bucket list items is to see a professional play in the middle […]

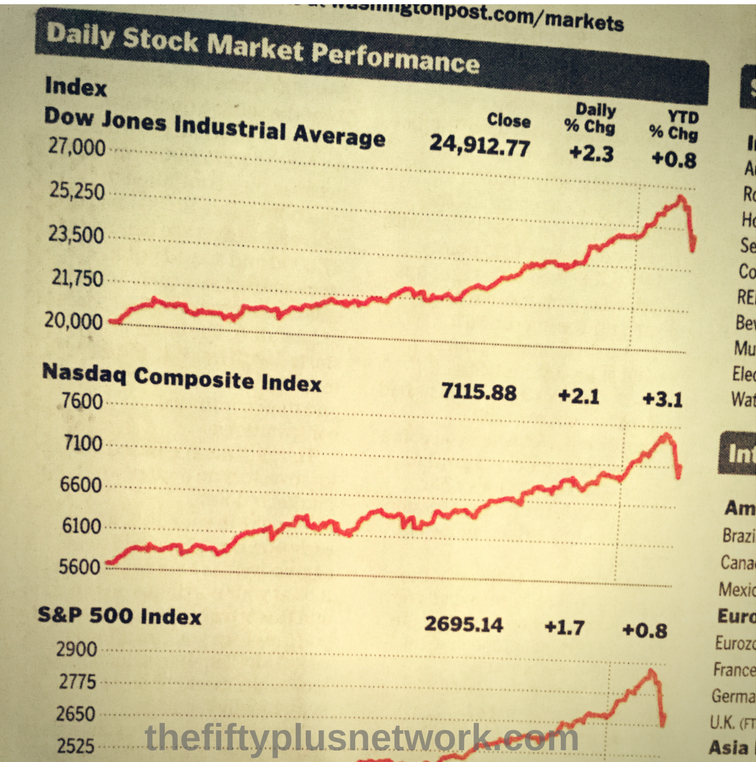

If you are retired, or within a few years of retiring, the recent volatility in the stock market must be […]

When I left my job for the last time, I drove away with a tear in my eye. I played […]

We got up at 5:30 am on Saturday morning to attend a retirement planning seminar. The most important advice imparted […]

![[Photo Courtesy: www.pixabay.com] thefiftyplusnetwork health healthy healthyliving healthylifestyle stretch your body move your body](http://thefiftyplusnetwork.com/wp-content/uploads/2017/04/thefiftyplusnetworkindex.png)

For new retirees, one of the most important activities to incorporate into your TDS is exercise. Why? If you are […]