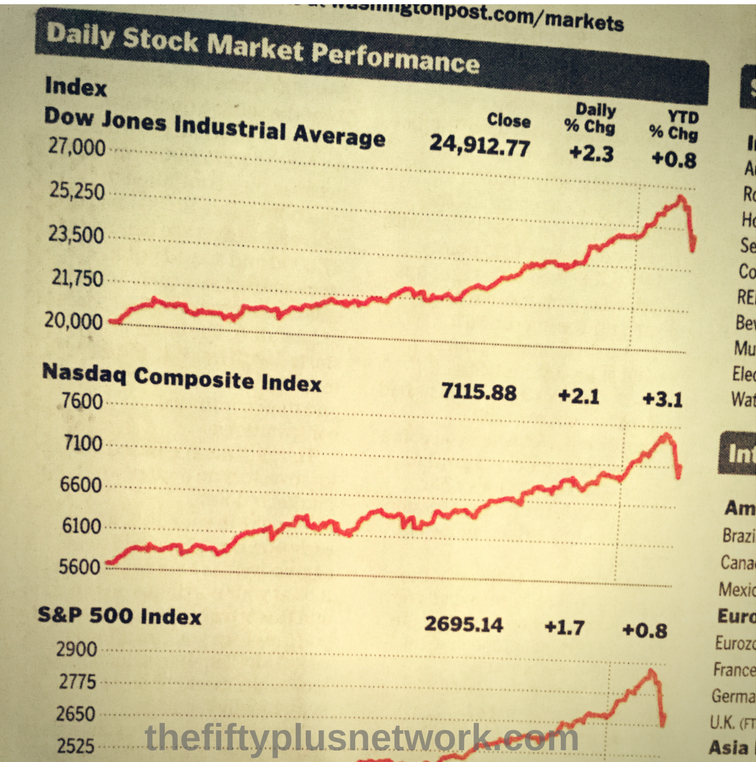

If you are retired, or within a few years of retiring, the recent volatility in the stock market must be unnerving … Retirees depend on their savings and investments to fund their lifestyle. Any risk to their nest egg raises red flags! For years and years you work to save for retirement, and one stock market crash can cut in it half! What to do?

- Don’t panic and sell into the crash. Remember — a loss is not a loss until you sell.

- Think long-term. It may take years to recover from a stock market crash, but as Mitt Romney said, “the market always comes back.”

- Calculate your annual living expenses and make sure you always have 2 – 3 years of living expenses saved in an FDIC-insured account.

We are old enough to remember the stock market crash of 1987. We were just starting out in our careers. On Monday, October 19, 1987, my husband called me around 4pm in the afternoon. He whispered to me, “the stock market lost over 500 points on the Dow.” The Dow Jones Industrial Average was only 2,246 points prior to the crash, so a loss of 500 points was a significant loss! At that time, we had a retirement account invested in Legg Mason Value Trust, a mutual fund. The mutual fund lost a third of it’s net asset value on that day. We panicked and sold the mutual fund the next day. We learned a valuable lesson: Stick it out because eventually the market will recover. To learn more about mutual fund investing, click Bogle On Mutual Funds: New Perspectives For The Intelligent Investor (Wiley Investment Classics).

If you are over 50 and have discovered a retirement planning tip, please share your tip by joining us at The Fifty Plus Network:

- Like us on Facebook

- Follow us on Twitter

- Follow us on Google+

- Subscribe to our YouTube channel

- Pin us on Pinterest

- Follow us on Instagram