What to Do About Choppy #StockMarkets! #retired #retirement #over50 #50plus

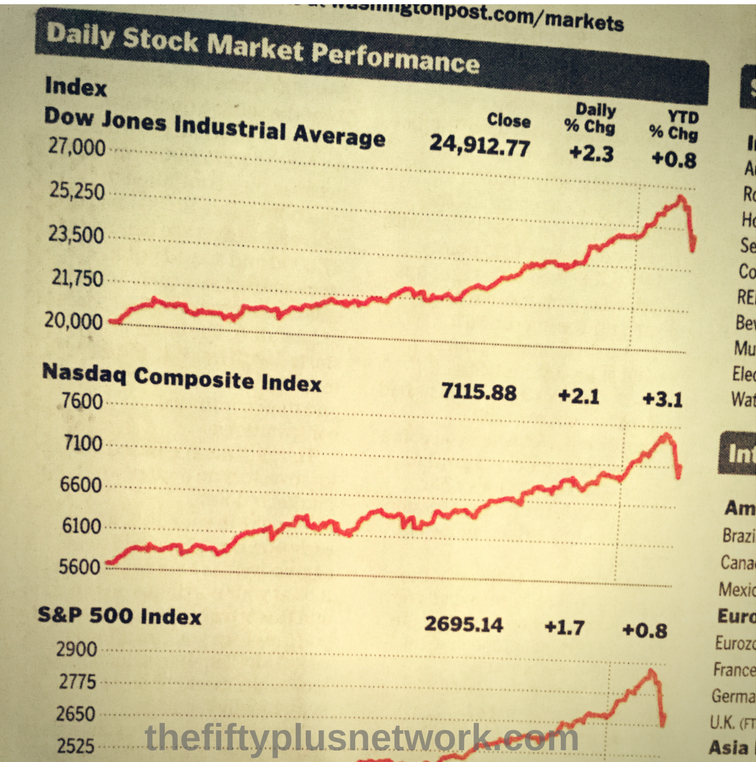

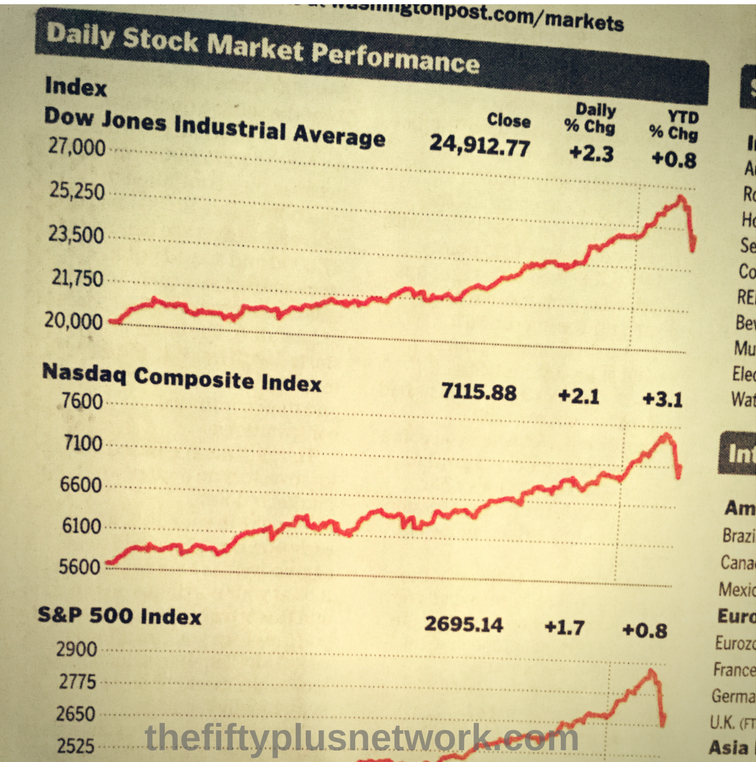

If you are retired, or within a few years of retiring, the recent volatility in the stock market must be […]

If you are retired, or within a few years of retiring, the recent volatility in the stock market must be […]

We got up at 5:30 am on Saturday morning to attend a retirement planning seminar. The most important advice imparted […]

![[Photo Courtesy: www.picserver.org]](http://thefiftyplusnetwork.com/wp-content/uploads/2015/07/financial_www_picserver_org.jpg)

You have sacrificed and saved for decades, and you are now ready to drop the 9-to-5 and spend your days […]

You have worked hard for decades. You have diligently saved money in your retirement accounts. You have invested in various […]