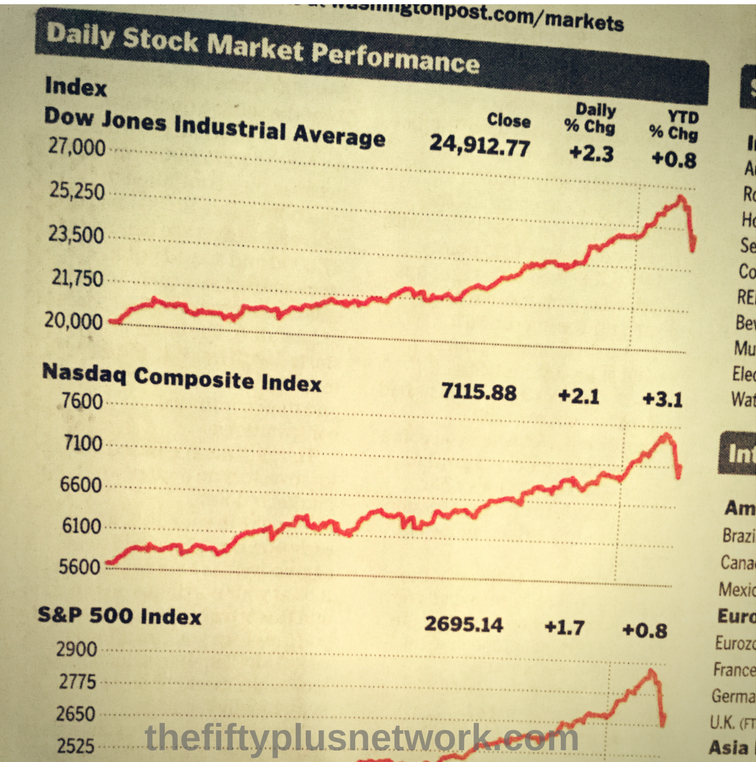

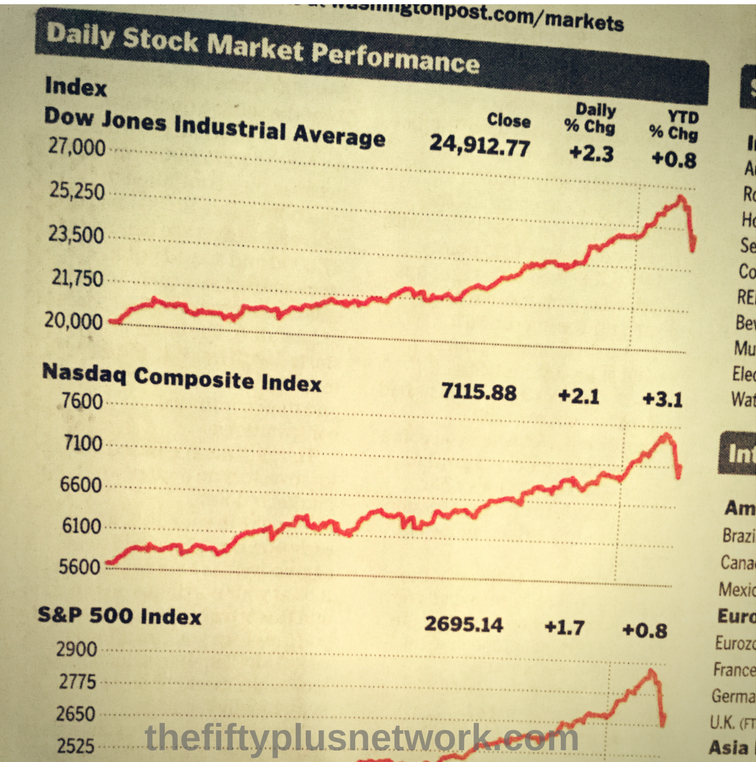

What to Do About Choppy #StockMarkets! #retired #retirement #over50 #50plus

If you are retired, or within a few years of retiring, the recent volatility in the stock market must be […]

If you are retired, or within a few years of retiring, the recent volatility in the stock market must be […]

We got up at 5:30 am on Saturday morning to attend a retirement planning seminar. The most important advice imparted […]